Describe the Characteristics of Bonds as Financial Assets

This degree focuses on preparation for careers in various accounting professions. Also preferred securities are often compared to sub-investment grade or high-yield bonds given the higher income opportunities.

Types Of Financial Assets Money Stocks Bonds Video Lesson Transcript Study Com

The better you spread your investments across different assets the less likely they are to all experience a loss.

. These bonds are an asset for banks in the same way that loans are an asset. Bonds or other assets. Upon the maturity date the issuer of the bond repays the principal amount of the loan.

The lender usually a financial institution is given security a lien on the title to the property until the mortgage is paid off in full. An issuers preferred securities will usually have a lower rating than the firms senior unsecured bonds. The percent of net assets invested in both domestic and foreign Equities common stocks preferred stocks rights and warrants convertible preferred stocks and stock index futures and options Bond all debt instruments including investment grade non-investment grade non-rated securities and convertible bonds and Cash Net Other Assets.

The process creates efficient markets and lowers the cost of conducting business. We would like to show you a description here but the site wont allow us. Several of the chapters that you will study are dedicated to an in-depth coverage of the special characteristics of selected assets.

87 Describe Fraud in Financial Statements and Sarbanes-Oxley. Financial performance is the achievement of the companys financial performance for a certain period covering the collection and allocation of finance measured by capital adequacy liquidity. But remember high-yield bonds by definition carry speculative-grade ratings so they do come with credit.

A mortgage loan is a very common type of loan used by many individuals to purchase residential or commercial property. As we discussed in the previous section financial controls are a key element of organizational success and survival. Long-term liabilities can include such liabilities as long-term notes payable mortgages payable or bonds.

Questionnaires are not only used to filter. Supporting documentation for any claims if applicable will be furnished upon request. A secured loan is a form of debt in which the borrower pledges some asset ie a car a house as collateral.

Government with a maturity of less than one year sold in denominations of. Government bonds are low-risk because the government is virtually certain to pay off the bond albeit at a low rate of interest. For example a financial advisor connects with clients through purchasing insurance stocks bonds real estate and other assets.

In economics capital goods or capital consists of those durable produced goods that are in turn used as productive inputs for further production of goods and services. A typical example is the machinery used in factories. Treasury Bill - T-Bill.

1 the balance sheet 2 the incomeprofit and loss PL statement and 3 the cash flow statement. Stocks bonds ETFs and other investment vehicles. There are three basic financial reports that all managers need to understand and interpret to manage their businesses successfully.

The asset allocation is managed on a manual basis by dedicated investment managers. Characteristics they promote describe how the use of those derivatives meets those characteristics Asset allocation. A Treasury bill T-Bill is a short-term debt obligation backed by the Treasury Dept.

A fiscal and accounting entity with a self-balancing set of general ledger codes in which cash and other financial resources together with all related liabilities and residual equities or balances and changes therein are recorded and segregated for the purpose of carrying on specific activities or attaining certain objectives in accordance with special regulations restrictions or limitations. Robo-Advisor 20 Investment portfolios are created as a fund of funds and setting up invest-ment accounts as well as direct order execution is part of the service. A bank is one of the major financial intermediaries because banks move funds from parties with excess capital to parties needing funds.

Warrants give the holder the right to purchase shares at a predetermined price for a predetermined period of time. The three main asset classes are stocks bonds and cash. A financial services firm a mutual fund company a brokerage firm an investment adviser or an insurance company that handles all of the transactions and investments within the plan.

At the macroeconomic level the nations capital stock includes buildings equipment software and inventories during a given year. Describes the share of investments in specific assets. It develops a common foundation in accounting and business and provides various courses covering both fundamental and specialized accounting topics to meet individual career goals.

The bank will receive a stream of payments in the future. Only for financial products referred to in Article 6 of Regulation EU 2020852. Customers must read and understand the Characteristics and Risks of Standardized Options before engaging in any options trading strategies.

In our example the Safe and Secure Bank holds bonds worth a total value of 4 million. Investments of the financial product including sovereign bonds while. Bonds are purchased at par value usually 1000 and pay a coupon rate or interest rate to the investor.

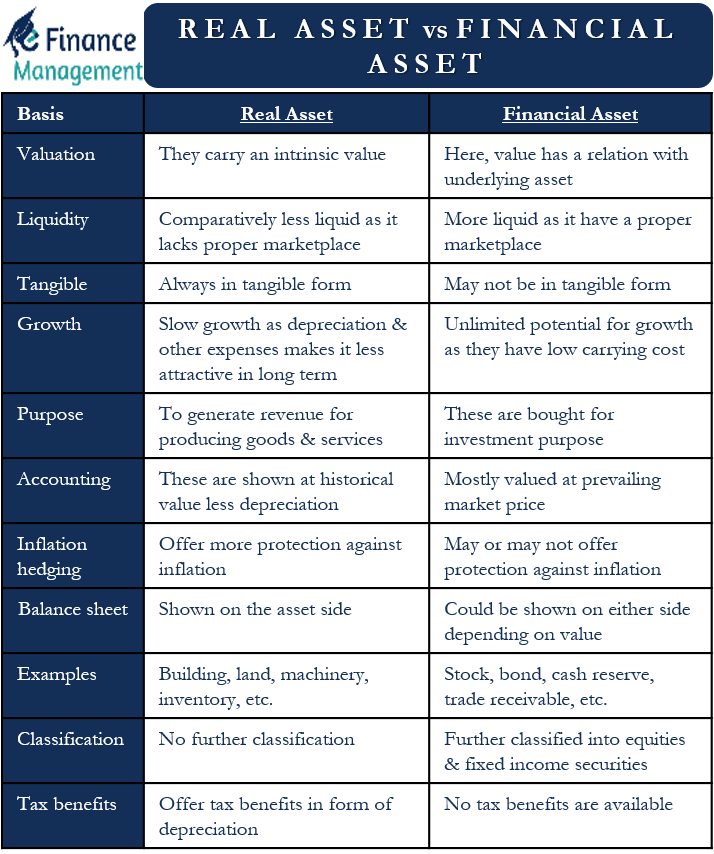

Investments that have similar characteristics.

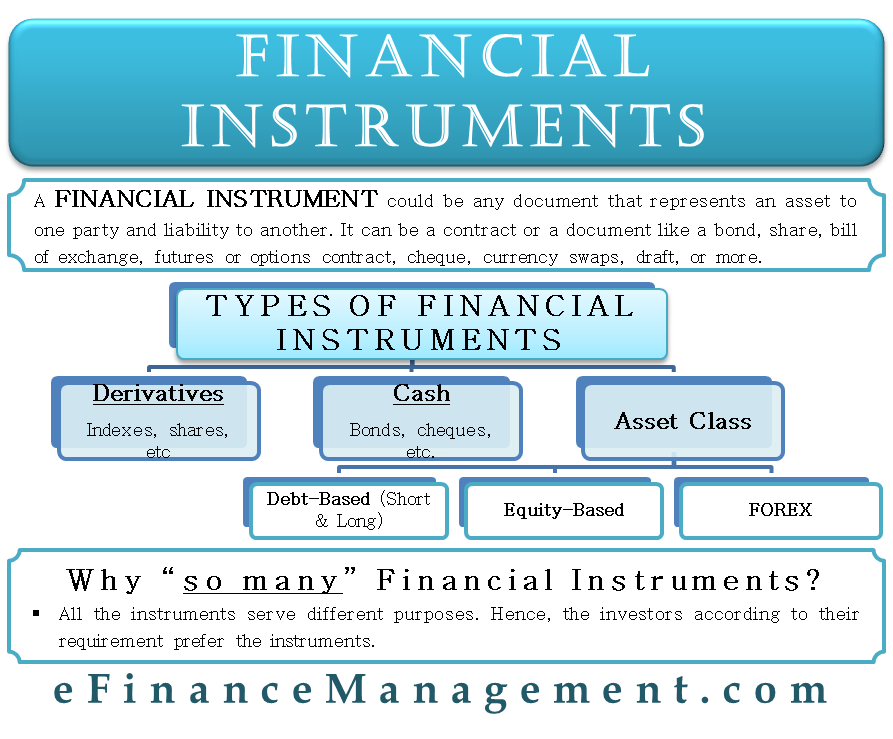

Financial Instruments What It Is Types And More

Classification Of Financial Assets Liabilities Ifrs 9 Ifrscommunity Com

/TermDefinitions_FinancialAsset_finalv1-f345ac704f414d63a87a86d485802338.png)

0 Response to "Describe the Characteristics of Bonds as Financial Assets"

Post a Comment